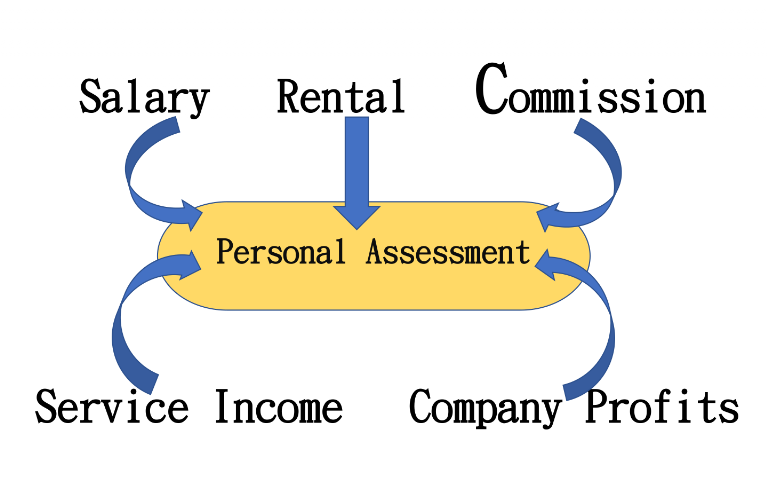

Personal Assessment

Taxation

Taxpayers can elect that property income and assessable profits are transferred to personal assessment

Taxpayers can enjoy the following deductions and allowances and total tax is calculated at progressive rate:

- Interest payable on loans for purchasing rental properties

- Home Loan Interest ($100,000)

- Domestic Rent ($100,000)

- Approved Charitible Donations

- Business losses

- Losses carried down previously under the Personal Assessment

- Personal allowances and relevant allowances

- Elderly Residential Care Expenses ($100,000)